Machinery financing can certainly be a headache for busy business owners in need of commercial equipment to complete urgent jobs or contracts and without the time to shop around for best deals. It may be tempting to just go with the first lender willing to approve your machinery loan but applying for a loan for machinery purchase does not have to mean being at the lender’s mercy at all. For example, our car broker friends at eCarz, a part of the eCarz group, can help you with your machinery financing needs. Together with eCarz, we have explained how to save on machinery financing, continue reading to find out more.

Heavy Equipment Financing Can Be Intimidating (But It Does Not Have to Be!)

Remember, you can always get help if you need it. There is a common misconception about finance brokers – as consumers, we tend to think that getting the help of a broker means paying someone else extra to do the legwork that we do not have the time for. This could not be further from the truth, however. For example, our friends at eCarz, on average, save their customers more on their purchases than they charge in broker fees, which means that as their client, you are very likely to come ahead compared to organising your heavy equipment financing yourself.

Saving on Your Loan for Machinery Purchase with the Help of a Machinery Loan Broker

A broker will have access and knowledge of a whole network of lenders and their heavy equipment financing products that you, as a regular consumer, would have to first research. For example, eCarz brokers work closely with a network of over forty lending specialists, giving them access to finance deals that the big banks might not want you to know about. As an industry insider, a finance broker is much better prepared to navigate and understand the confusing language used by the lending industry. A broker’s expertise saves you time that you would have to spend researching the jargon to even understand whether you are getting a deal or getting ripped off. Quite simply, as a non-specialist, you are unlikely to sift through all of the finance products available on the market and pick the best one for you, not as quickly and as efficiently as a finance broker will anyway. A broker will make applying for your loan for machinery purchase simple by not wasting your time with application forms and busywork. They will know how to get your finance approved at the best rate possible for you and faster, saving you time and money. It is in the broker’s best interest to help you after all!

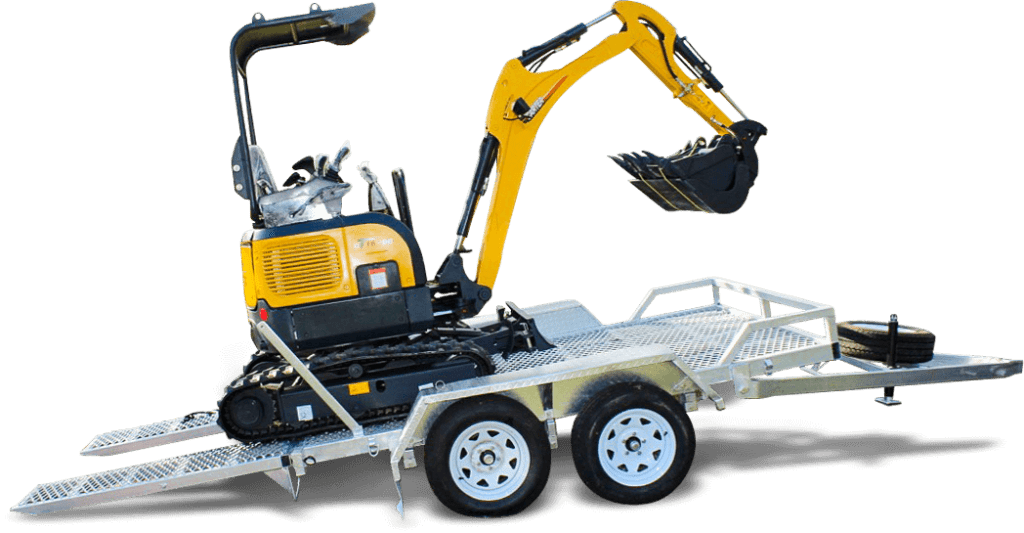

We hope you have found our ideas on how to save on machinery financing helpful. Are you looking to buy commercial machinery or equipment? Browse the Machinery Direct range of machinery sales. If you require machinery financing, we can help you with that too! Apply for a machinery loan pre-approval at Machinery Direct today to get started!